Hello readers!! Firstly wishing u a very Happy New Year and hope this year brings lots of wealth in your kitty and you have a healthy life ahead.

I know it’s been a lot of days since I last blogged about any stock idea and without bothering much of your time let me get started …so here we go

About the company

Steel Strips Wheels Ltd (SSWL), a part of the multifaceted Steel Strips group is into manufacturing of steel wheels for automotive industry. It products range comprises of steel wheels for Passenger car (PC), Multi utility Vehicle (MUV), Tractors, Trucks, Light Commercial vehicle (LCV), Heavy Commercial vehicle (HCV), Off the road vehicle (OTR), as well as 2 and 3 wheelers.

SSWL has 3 manufacturing facilities strategically located in Punjab, Tamil Nadu and Jharkhand in order to cater to the requirement of its Indian and International customers with total capacity of 16 mn wheels.

*The Jamshedpur plant is currently enhancing its capacity to 1.7 mn wheels which is expected to be completed by Q4FY12.

SSWL has a technical assistance agreement with Ring Tech Co. Ltd, Japan (100% subsidiary of Sumitomo Metals Ltd, Japan) a world renowned steel wheels manufacturing company.

Over the years SSWL has expanded its customer’s base and has been a strong and reliable partner to the Indian and International Automotive Industry and is well recognized as a global player in the development and manufacturing of steel wheels for the OEMs.

Over the years SSWL has expanded its customer’s base and has been a strong and reliable partner to the Indian and International Automotive Industry and is well recognized as a global player in the development and manufacturing of steel wheels for the OEMs. Operational Performance

In FY11 SSWL derived major revenues from PC segment which contributed around 61% of the total revenues followed by Tractors and LCV/HCV segments with 21% and 12% respectively. The rest came from OTR and 2/3 wheelers segment.

SSWL enjoys a healthy market share of 49.78% in PC segment, 33.53% in Tractors segment and 4.23% in LCV/HCV segment.

With commissioning of Jamshedpur plant mainly catering to LCV/HCV, has given a big boost to the top line and also sales price per unit in FY11. It is currently enhancing its capacity to 1.7 mn wheels which is expected to be completed by Q4FY12 thus will have a positive push to both the top line and margins in the future.

SSWL’s export currently stand at around 11% of the total revenues and is a major supplier to global majors like Renault & Peugeot in the Cars segment, PIAGGIO in the scooter segment & the Kubota group (Thailand) in the tractor segment.

SSWL has shown a decent growth over the period of time with adding up more capacities and acquiring customers has helped them to meet the rising demand and increase its market share.

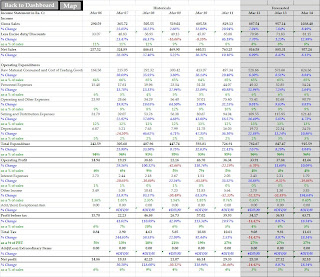

FY12 Key Performance

The company has managed to do a sale of 75.81 lacs wheels for the 9 months period which is an increase of 7% compared to the same period last year. On the quarterly basis the wheels sales has shown a decreasing trend due to strike at Maruti Suzuki Ltd plant which is one of the major customer for the company and also due to declining domestic economic conditions which is a cause of concern in the short run.

This is the result of increased capacity in Chennai and Dappar unit along with changes in product mix enabling the company to achieve higher growth in the current fiscal. SSWL was also successful in getting exports orders from Renault, BMW, AUDI and other European players thus showing the company’s ability to produce high quality products and revenue visibility for the coming future.

At the same time the company’s margins have got hit heavily due to inflationary pressure increasing the over all input costs and higher interest rates, which is a big cause of worry for the company. This also gives an idea that the company is lacking pricing power and is not able to pass on the increased cost easily to the end user thus bringing the margins down which can also be observed from the yearly figures of the company.

With the wheels sales figures available for quarter ending Dec-11 it is expected the growth to be negative to flat for the company with pressure on margins remaining intact.

The GOOD

· Huge demand in future: The automotive industry has emerged as one of the prominent manufacturing sectors of the Indian economy. Domestic players in the automotive OEMs are adding capacities to meet future demand, driven by both buoyant domestic market and growing vehicle export market, particularly for small cars, two wheelers and light commercial vehicles. New entrants in the market like Renault, Volkswagen, AUDI and BMW will aid in increasing the depth of the passenger car market. Also in commercial vehicle market big International players like Volvo, MAN Force Motors have also set up shop in India. This move signals their confidence in the robust growth outlook for the Indian CV market over the medium to long term, even though their initial capacities are not substantial.

· One of the highest capacities in Asia: Over the years SSWL has gradually increased their installed capacity to more than 16 mn wheels and is now sitting on with one of the highest capacities in Asia. This will help company to get large orders and meet the growing demand in the future easily.

· Strong customer base: SSWL has built a large customer base. Today it has almost all major Indian auto players as its customers. Moreover, company has also served a few large global manufacturers. The company has maintained a strong relationship with its clients which will enable the company to boost it top-line growth going forward.

· Excellent growth historically:

SSWL has shown a decent growth over the period of time with adding up more capacities and acquiring customers has helped them to meet the rising demand and increase its market share. SSWL is now focusing more on LCV/HCV segment which will contributes more to the top line and EBITDA margins for the coming future. Increase in share of exports sales spells positive development for the company.

Increasing Promoters stake:

· The promoters in the recent past have been buying the stock from the market and increasing their stake in the company which shows that the management is confident of their business and expect it to grow in the coming future which is big positive sign. To fund its expansion the company in Dec-10 and Jan-11 made a preferential allotment of shares to Sumitomo Metals Industries Ltd, Japan(8.5 lacs shares @Rs520/share) and GS Global Corp (3.77 lacs shares @Rs 595/share) constituting 5.73% and 2.54% of the total enhanced paid up capital of the company as on Mar-11 respectively. Giving such a high valuation for the company reflects the potential of the company being very strong.

The BAD

· Higher input cost:

Controlling cost has been one of the major issues for the company which has been on an upper side consistently. SSWL has majorly financed its growth through debt, which resulted in increase of interest burden on the company. All this has clearly put more pressure on profitability of the company.

· Decreasing Margins:

Lack of pricing power and consistently increase in cost has led to decrease in margins for the company. Tough economic conditions coupled with higher interest rate and only marginal increase in sale of wheels has further brought down the Net Profit margins to 4% for the last TTM.

· Mediocre returns:

Over the years to increase its market share the company has compromised on its margins affecting the EPS and other return ratios is not a healthy sign and has been a poor show from returns front.

The UGLY

· Huge Debts on books: SSWL has been financing its fixed assets and working capital requirement through internal accruals and majorly through debt route. In FY11 it had also diluted its stake for some additional capital. Over the period of time this debt has been piling up and the company has not been able to generate enough returns to pay down this debt. As on 30/9/11 its current debt stands at Rs. 447.18 cr and its D/E ratio stand at 1.56 times which is very high. This poses the biggest risk as higher interest rates will increase its interest burden and further drag its PAT and other ratios down.

· High working capital requirement:

With increase in capacities its working capital requirement has also increased, blocking a reasonable amount of cash and this has led them to increase its debt at various intervals. The balance sheet on a whole does not look very strong and in the current economic environment it looks like it will get worse if things does not turnaround fast.

· Negative FCF historically:

Constant need for increasing its fixed assets to capture the market share the company has not been able to generate any FCF for even a single period in last 6 years. This again with tight working capital has resulted in lower cash flow from operating activities which has led them to go for debt route for capital.

Looking at the current business model it seems like to grow in the future and increase its market share it has to go for increasing its installed capacity. And the company will have to look for either debt or go for dilution which again is a red flag for the equity shareholders of the company as its further pressurizes the profitability of the company.

Conclusion

On the whole it seems a very interesting case where the business they are into has got huge potential to grow as India being rated as the next automotive hub. SSWL is nicely positioned itself with most of the Automobile manufacturer under its customers list, brings huge opportunity in the future. On the contrary the way the management has shaped this company it seems that the going gonna be tough.

At this juncture I am not very comfortable in investing in this company and will wait to see how things shape up in the coming future.

I hope the management has kept their Fingerscrossed and hoping to put the numbers in place.

Views invited !!!

Happy Investing !!!